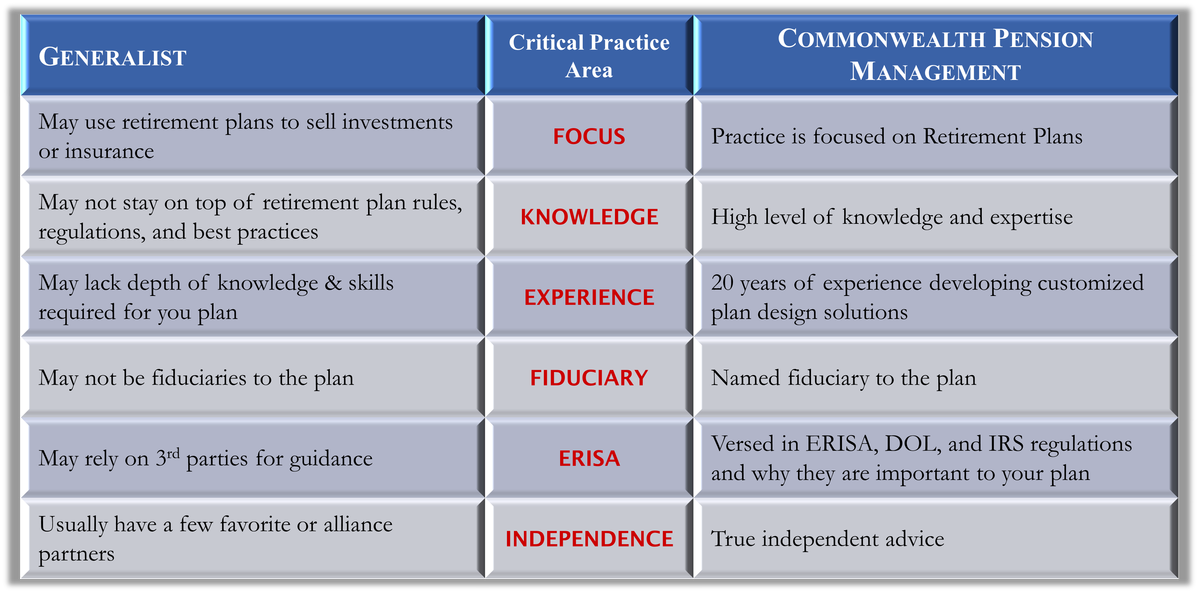

Why hire an Independent Retirement Plan Specialist?

Hiring an advisor is a critical business decision. Your plan advisor must deliver the Support you and your employees need for an effective plan. Your plan advisor must provide the Service to help manage your plan. Your plan advisor must offer Guidance for the long-term success of your plan.

Commonwealth Pension Management will deliver the Support, provide the Service, and offer the Guidance your plan deserves. Our goal is to translate our knowledge into improvements in plan performance and retirement outcomes, and helping to simplify plan administration and reduce costs.

We help you manage your fiduciary duty of providing a plan for the benefit of the plan participants and their beneficiaries.

What We Do

- We partner with you to identify your top plan goals, issues, and needs and develop comprehensive, effective solutions that are tailored for your plan

- We focus on managing costs, assisting with fiduciary duties, and helping to increase participant outcomes to deliver a plan that benefits plan participants and their beneficiaries

- We provide support with quarterly plan monitoring

- We stay abreast of regulatory and legislative changes keeping you informed of relevant developments

- We always work for the participants and their beneficiary's best interest

- Our dynamic service model helps you be confident that a firm with proper training and knowledge will be guiding you

What We Deliver

- Act in ERISA 3(21) Fiduciary capacity

- Assistance with plan design, implementation, and optimization

- Preperation assistence and review of your plan's Investment Policy Statement

- Advise on creating and maintaining an investment lineup

- Provide education for plan participants and employees

- Conduct group and individual meetings for plan participants and employees

- Monitor plan activities

- Produce quarterly investment monitoring reports

- Produce annual fee benchmarking reports

- Assist plan fiduciaries with selecting and monitoring plan service providers

- Meet at least annually with plan fiduciaries for a complete plan review

This information was developed as a general guide to educate plan sponsors, but is not intended as authoritative guidance or tax or legal advice. Each plan has unique requirements, and you should consult your attorney or tax advisor for guidance on your specific situation. In no way does advisor assure that, by using the information provided, plan sponsor will be in compliance with ERISA regulations.